Trading cryptocurrencies can be exciting, but choosing the right platform matters. Today we’re comparing two popular exchanges: Aibit and BitMEX. Both platforms offer crypto derivatives trading, but they have key differences in features, fees, and user experience.

When choosing between Aibit and BitMEX, you should consider factors like trading fees, available cryptocurrencies, leverage options, and platform security.

Each platform has strengths that might appeal to different types of traders. BitMEX has been around longer and offers high trading volumes, while newer competitors often provide more user-friendly interfaces and different fee structures. Your trading style, experience level, and specific needs will determine which platform works best for you.

Aibit vs BitMEX: At A Glance Comparison

When looking at cryptocurrency exchanges, Aibit and BitMEX offer different features that might suit your trading needs. Here’s how they compare side by side.

Trading Experience

| Feature | Aibit | BitMEX |

|---|---|---|

| User Interface | Modern, intuitive | Technical, more complex |

| Mobile App | Yes | Yes |

| Trading Tools | Advanced charting | Professional-grade tools |

Aibit provides a more streamlined experience that newer traders might find easier to navigate. BitMEX tends to cater to experienced traders who need advanced features.

Products and Services

- Aibit offers spot trading, futures, and options

- BitMEX focuses primarily on derivatives and futures contracts

- Both provide leverage trading, but with different maximum limits

Fee structures differ between the platforms. Aibit typically offers competitive maker/taker fees compared to BitMEX’s fee schedule.

Security Features

- Both use cold storage for most funds

- Two-factor authentication available on both platforms

- BitMEX has been operating longer with an established security record

Geographic restrictions apply differently to each platform. You should check if your region has access to either exchange before signing up.

Trading volume can impact your experience, especially for large orders. BitMEX historically has deeper liquidity for Bitcoin derivatives, while Aibit may offer better liquidity for certain altcoin pairs.

Aibit vs BitMEX: Trading Markets, Products & Leverage Offered

Both Aibit and BitMEX offer cryptocurrency derivative trading products, but they differ in several important aspects.

BitMEX is one of the older platforms in the crypto derivatives space. It offers Bitcoin futures and swaps with up to 100x leverage. This high leverage allows you to amplify your potential profits, but also significantly increases risk.

BitMEX processes approximately 500 orders per second according to testing data. This speed is sufficient for most traders but may lag during extremely volatile market conditions.

Aibit is a newer platform that has been gaining popularity. Like BitMEX, it offers cryptocurrency derivatives trading with high leverage options.

Available Products Comparison:

| Feature | BitMEX | Aibit |

|---|---|---|

| Max Leverage | Up to 100x | Up to 100x |

| Perpetual Swaps | Yes | Yes |

| Futures Contracts | Yes | Yes |

| Order Processing | ~500 orders/sec | Comparable to competitors |

| Trading Pairs | BTC and major altcoins | BTC and major altcoins |

Both platforms focus primarily on Bitcoin trading pairs, though they do offer other cryptocurrency markets as well.

When choosing between these platforms, consider your specific trading needs. If you’re looking for established history, BitMEX has been around longer. However, many traders are moving to newer platforms like Aibit for potentially better features.

Trading fees also differ between the platforms, which can impact your profitability when trading with high leverage.

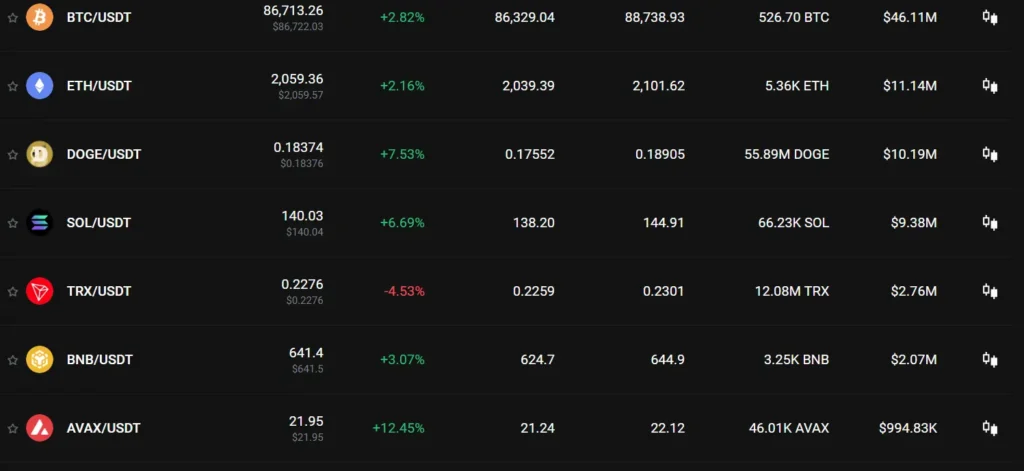

Aibit vs BitMEX: Supported Cryptocurrencies

When choosing between Aibit and BitMEX, the range of supported cryptocurrencies is an important factor to consider for your trading needs.

BitMEX focuses primarily on Bitcoin-based contracts. You can trade Bitcoin (XBT/USD) as their main offering, along with a selection of major altcoins including Ethereum (ETH), Litecoin (LTC), and XRP.

Aibit offers a wider variety of cryptocurrency pairs. You can access major coins like Bitcoin, Ethereum, and Solana, as well as numerous altcoins and emerging tokens.

Here’s a comparison of their supported cryptocurrencies:

| Platform | Bitcoin | Ethereum | Altcoins | Total Cryptocurrencies |

|---|---|---|---|---|

| BitMEX | ✓ | ✓ | Limited | 5-10 |

| Aibit | ✓ | ✓ | Extensive | 20+ |

BitMEX is more focused on providing deep liquidity for fewer pairs. This makes it suitable if you primarily trade major cryptocurrencies.

Aibit gives you access to a broader cryptocurrency ecosystem. This makes it better if you want to diversify your trading across emerging tokens.

Both platforms regularly review and may add new cryptocurrencies based on market demand and liquidity requirements. You should check their current offerings before making your final decision.

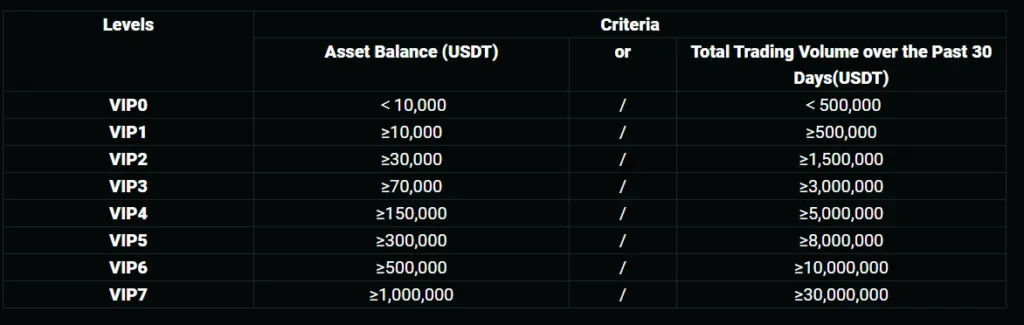

Aibit vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and BitMEX, fees can significantly impact your trading profits. Let’s examine how these platforms compare in terms of costs.

BitMEX offers competitive trading fees with a maker fee of -0.025% and a taker fee of 0.075%. The negative maker fee means you actually receive a rebate when adding liquidity to the market.

Based on the latest data as of March 2025, BitMEX maintains these low fees to attract traders. Their fee structure is transparent and straightforward.

Aibit’s fee structure is competitive in the market, though not as widely documented in the search results. When comparing the two platforms, you’ll need to consider both the base fees and any potential discounts based on trading volume.

Fee Comparison Table:

| Fee Type | BitMEX | Aibit |

|---|---|---|

| Maker Fee | -0.025% (rebate) | Varies |

| Taker Fee | 0.075% | Varies |

For deposit fees, both platforms generally offer free cryptocurrency deposits. However, withdrawal fees vary depending on the cryptocurrency and network congestion.

BitMEX has established a reputation for maintaining reasonable withdrawal fees despite its advanced trading features.

When selecting between these exchanges, consider your trading style. If you’re a market maker providing liquidity, BitMEX’s negative maker fees could be advantageous for your strategy.

Remember that fees may change over time, so checking the official websites for the most current rates is always recommended before making your decision.

Aibit vs BitMEX: Order Types

When trading on cryptocurrency platforms, order types can make a big difference in your strategy. Both Aibit and BitMEX offer various order options, but they have some key differences.

BitMEX provides several order types to fit different trading approaches. These include Market, Limit, Post-Only Limit, Stop Market, and Stop Limit orders.

One standout feature on BitMEX is their Take Profit orders, which come in two varieties: Take Profit Market and Take Profit Limit. The Market version places a market order when your trigger price is reached.

BitMEX also offers Post-Only options that can be applied to Limit, Stop Limit, or Take Profit Limit orders. This prevents your order from taking liquidity from the market.

Aibit generally offers the standard order types found on most platforms, though they may have fewer specialized options compared to BitMEX.

When choosing between these platforms, consider your trading style. If you use complex strategies requiring specialized order types, BitMEX might be more suitable with its wider range of options.

For newer traders, Aibit’s simpler approach could be less overwhelming. BitMEX’s interface can sometimes be complex for beginners despite offering more advanced features.

Your trading frequency and volume should also factor into your decision, as the available order types will affect how efficiently you can execute your strategy.

Aibit vs BitMEX: KYC Requirements & KYC Limits

BitMEX has faced serious legal issues due to past KYC failures. In 2021, they were fined $100 million for failing to establish proper anti-money laundering (AML) programs and know-your-customer (KYC) procedures. This happened because they served U.S. customers without following required regulations.

BitMEX now has strict KYC requirements for all users. You must provide valid ID documents and complete identity verification before trading. The exchange learned a hard lesson about regulatory compliance.

Aibit also implements KYC procedures, but their approach differs slightly. Their verification process is typically tiered, allowing limited functionality with basic verification and more features as you complete additional verification steps.

BitMEX KYC Requirements:

- Government-issued photo ID

- Proof of residence

- Facial verification

- Compliance with international AML standards

Aibit KYC Requirements:

- Basic tier: Email and phone verification

- Intermediate tier: ID verification

- Advanced tier: Proof of address and additional documentation

The KYC limits on each platform affect how much you can deposit, withdraw, and trade. BitMEX tends to have higher limits for fully verified users, reflecting their institutional focus.

When choosing between these exchanges, consider how their KYC processes align with your privacy preferences and trading needs. BitMEX’s stringent requirements result from regulatory pressure, while Aibit’s tiered approach offers more flexibility for casual traders.

Aibit vs BitMEX: Deposits & Withdrawal Options

When choosing between Aibit and BitMEX, understanding their deposit and withdrawal options is crucial for smooth trading experiences.

Deposit Methods

Both platforms primarily accept cryptocurrency deposits. BitMEX focuses mainly on Bitcoin deposits, while Aibit offers a slightly wider range of cryptocurrencies for funding your account.

Neither exchange currently supports fiat currency deposits directly. You’ll need to purchase crypto elsewhere before transferring to these platforms.

Withdrawal Fees

BitMEX charges around 0.0001 BTC for Bitcoin withdrawals. This fee structure has remained relatively stable.

Aibit’s withdrawal fees are generally competitive, though specific rates vary by cryptocurrency. Based on available information, their fees appear to be lower than industry averages.

Processing Times

BitMEX processes withdrawals once daily at a scheduled time. This means you might wait several hours for your withdrawal to be processed.

Aibit typically offers faster withdrawal processing times, which can be advantageous if you need quick access to your funds.

Security Features

Both platforms implement security measures for withdrawals, including:

- Multi-signature wallets

- Email confirmations

- Two-factor authentication requirements

Minimum Withdrawals

Each platform enforces minimum withdrawal amounts that vary by cryptocurrency. Be sure to check these limits before initiating a withdrawal to avoid transaction issues.

Remember to verify all deposit addresses carefully when transferring funds to either platform to prevent loss of assets.

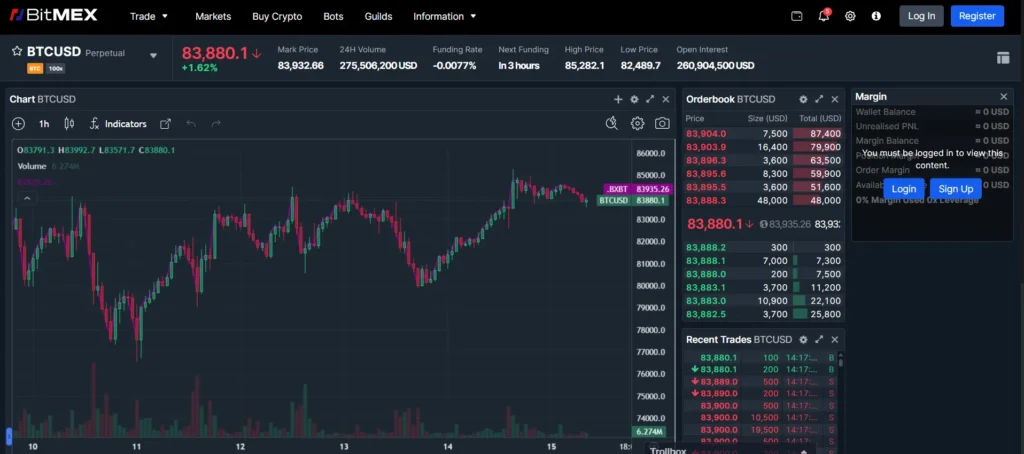

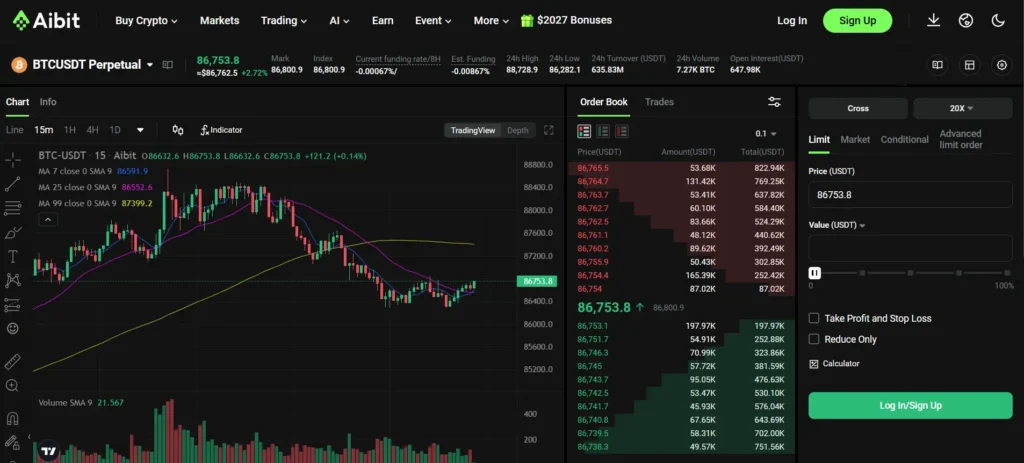

Aibit vs BitMEX: Trading & Platform Experience Comparison

When choosing between Aibit and BitMEX, the trading experience differs in several key ways. Both platforms cater to cryptocurrency traders, but they offer unique features.

BitMEX has been around longer and has built a reputation for high trading volumes. It offers a robust platform with advanced charting tools that experienced traders appreciate.

Aibit (sometimes confused with Bybit in search results) provides a more user-friendly interface. This makes it potentially better for newer traders who want an easier learning curve.

Trading Tools Comparison:

| Feature | Aibit | BitMEX |

|---|---|---|

| User Interface | More intuitive | More technical |

| Mobile App | Fully featured | Basic functionality |

| Order Types | Standard + advanced | Comprehensive |

| Charting Tools | Moderate | Advanced |

BitMEX tends to have higher liquidity for Bitcoin trading pairs. This can result in tighter spreads and less slippage when you place large orders.

The execution speed varies between platforms. BitMEX sometimes experiences overload during high volatility, while Aibit claims to have higher processing power.

When trading on either platform, you’ll notice differences in the contract specifications. BitMEX offers unique perpetual contracts with funding mechanisms that experienced traders often prefer.

Risk management tools are available on both platforms. You can set stop-losses and take-profits to manage your positions effectively regardless of which platform you choose.

Aibit vs BitMEX: Liquidation Mechanism

When trading on cryptocurrency platforms, understanding liquidation mechanisms is crucial for managing risk. Both Aibit and BitMEX have systems in place to prevent losses during volatile market conditions.

BitMEX uses a sophisticated Liquidation Process designed to avoid immediate position closures. They implement a Fair Price Marking system that protects traders from liquidations caused by temporary market manipulation or illiquidity.

The platform also employs Risk Limits that require higher maintenance margins as position sizes increase. This graduated approach helps manage exposure for both traders and the exchange.

Aibit’s liquidation mechanism differs in several key aspects:

| Feature | BitMEX | Aibit |

|---|---|---|

| Price Reference | Dual index system | Single index system |

| Liquidation Speed | Gradual process | More immediate |

| Partial Liquidations | Yes | Limited |

| Maintenance Margin | Variable based on position size | Fixed percentage |

Some BitMEX users have reported issues with the platform’s dual index system. In rare cases, profitable positions were liquidated when one of their two price indexes experienced technical issues.

You should consider these differences when choosing between platforms. BitMEX’s system might offer more protection against market volatility, but its complexity can sometimes lead to unexpected outcomes.

The liquidation mechanism directly impacts your trading strategy and risk management. Understanding how each platform handles extreme market movements will help you make informed decisions about where to place your trades.

Aibit vs BitMEX: Insurance

When trading on cryptocurrency exchanges, insurance funds provide a safety net for traders. Let’s compare how Aibit and BitMEX handle insurance protection.

BitMEX maintains an Insurance Fund to protect traders from losses during extreme market conditions. This fund helps avoid Auto-Deleveraging in traders’ positions, which is when profitable traders have their positions reduced when the system can’t close losing positions at the bankruptcy price.

The BitMEX Insurance Fund is used to manage unfilled liquidation orders. It gives winning traders assurance they’ll receive their expected profits, even when markets are volatile.

Aibit also offers an insurance mechanism, though it operates differently from BitMEX. Their system aims to protect user funds and maintain platform stability during unexpected market movements.

When choosing between these platforms, consider how important this safety feature is for your trading style. If you frequently use leverage or trade volatile assets, robust insurance protection may be a priority.

Here’s a quick comparison:

| Feature | BitMEX | Aibit |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Auto-Deleveraging Protection | Yes | Varies |

| Transparency | Fund size publicly available | Limited information |

The strength of an exchange’s insurance fund can indicate its financial stability and commitment to trader protection. You should check the current size and policies of each exchange’s fund before making your decision.

Aibit vs BitMEX: Customer Support

When choosing between Aibit and BitMEX, customer support plays a crucial role in your trading experience. Both platforms offer support, but they differ in several key aspects.

Aibit provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. Their response times typically range from a few minutes to a few hours depending on the complexity of your issue.

BitMEX, on the other hand, mainly relies on email support and their knowledge base. Their response times can be longer, sometimes taking up to 24 hours during busy periods.

Response Time Comparison:

| Platform | Live Chat | Average Response Time | |

|---|---|---|---|

| Aibit | Yes | Yes | 1-3 hours |

| BitMEX | No | Yes | 12-24 hours |

Aibit’s support team is known for handling technical issues efficiently, particularly during high market volatility. They offer support in multiple languages, making them accessible to a global user base.

BitMEX’s support has improved over time, but still focuses primarily on English-speaking users. Their knowledge base is extensive, which can help you solve many common problems without direct support.

Neither platform offers phone support, which is worth noting if you prefer direct verbal communication for resolving issues.

The quality of troubleshooting also differs. Aibit’s representatives can usually solve problems in one interaction, while BitMEX might require multiple follow-ups for complex issues.

Aibit vs BitMEX: Security Features

When trading cryptocurrencies, security should be your top priority. Both Aibit and BitMEX offer various security features to protect your assets.

Aibit implements strong encryption protocols to safeguard your personal information and funds. They use two-factor authentication (2FA) to add an extra layer of security to your account.

BitMEX also offers 2FA and uses cold storage wallets to keep most user funds offline. This approach significantly reduces the risk of hacking attempts.

Key Security Features Comparison:

| Feature | Aibit | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Partial | Majority of funds |

| IP Whitelisting | ✓ | ✓ |

| Withdrawal Confirmation | Email & SMS | |

| Insurance Fund | Limited | Extensive |

Both platforms monitor accounts for suspicious activities. They will alert you if they detect unusual login attempts or transactions.

Aibit offers customizable security settings that let you control access to your account. You can set withdrawal limits and create IP address restrictions.

BitMEX has built a solid reputation for security since its founding. They’ve faced fewer security incidents compared to many other exchanges in the industry.

Remember to always use strong, unique passwords and enable all available security features regardless of which platform you choose. Your own security practices play a crucial role in keeping your crypto assets safe.

Is Aibit a Safe & Legal To Use?

Aibit is a newer cryptocurrency exchange that many investors are exploring. When looking at its safety and legality, several aspects need consideration.

Aibit appears to operate as a legal entity in its registered jurisdictions. However, regulations vary by country, so you should verify its status in your location before using it.

Safety Features:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

Unlike BitMEX, which faced a $100 million fine for violating the Bank Secrecy Act, Aibit hasn’t had major regulatory issues reported so far.

Your funds’ safety depends on both the exchange’s security measures and your own practices. Using strong passwords and enabling all security features is essential.

Aibit implements KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to remain compliant with international standards. This helps protect the platform from illegal activities.

Risk Factors:

- Limited operating history compared to established exchanges

- Evolving regulatory landscape for crypto exchanges

- Potential for hacks (common to all exchanges)

You should consider using hardware wallets for long-term storage rather than keeping large amounts on any exchange. This reduces your exposure to platform risks.

Trading platforms always carry some level of risk. Aibit seems to follow industry standards for security, but you should do your own research before depositing significant funds.

Is BitMEX a Safe & Legal To Use?

BitMEX has been around for several years in the crypto trading space, but its safety profile raises some questions. The platform uses multi-signature wallet security to protect user funds, which is a positive security feature.

However, BitMEX lacks significant regulatory licenses and doesn’t provide deposit insurance. This means your funds don’t have the same protections you might find on more regulated exchanges.

The platform has faced several controversies over time. There have been ongoing complaints, investigations, and allegations of misconduct that potential users should be aware of.

Most users suggest a practical approach to using BitMEX: only keep what you need for active trading on the platform. Avoid accumulating large amounts of cryptocurrency on the exchange for long-term storage.

BitMEX’s legality varies by location. The platform has faced regulatory challenges in some countries, so you should verify whether it’s permitted in your jurisdiction before signing up.

Key Safety Considerations:

- Multi-signature wallet security ✓

- No deposit insurance ✗

- History of regulatory issues ✗

- Limited compliance certifications ✗

While BitMEX functions as a trading platform, the various issues in its history suggest you should exercise caution when using it. Always research the current regulatory status of BitMEX in your country before opening an account.

Frequently Asked Questions

Traders often need clear answers when deciding between cryptocurrency platforms. These common questions highlight key differences between Aibit and BitMEX to help you make an informed choice.

What are the main differences between Aibit and BitMEX trading platforms?

BitMEX focuses primarily on perpetual contracts and futures trading with leverage up to 100x. It offers a more technical interface with advanced charting tools.

Aibit provides a broader range of trading options and generally offers a more user-friendly interface. While BitMEX has been around longer, Aibit typically provides more modern features and updated technology.

The trading engines also differ in execution speed, with each platform having its own advantages during different market conditions.

How do the fee structures of Aibit and BitMEX compare?

BitMEX uses a maker-taker fee model where market makers receive rebates (typically 0.025%) while takers pay fees (around 0.075%) on most contracts.

Aibit’s fee structure is generally competitive but varies based on trading volume and account tier. Both platforms charge funding fees for perpetual contracts which are paid between long and short position holders.

BitMEX tends to have higher withdrawal fees compared to Aibit, which can impact overall trading costs for frequent withdrawals.

Which platform offers better security features, Aibit or BitMEX?

BitMEX implements multi-signature wallets and cold storage for the majority of user funds. They also offer two-factor authentication and IP address whitelisting.

Aibit provides similar security features but has added newer protection mechanisms like anti-phishing codes and advanced risk management systems.

Both platforms have experienced security incidents in the past, but have since strengthened their security protocols. Your choice might depend on which security features matter most to you.

Can United States residents legally trade on BitMEX or Aibit?

Neither BitMEX nor Aibit officially accepts traders from the United States due to regulatory restrictions. BitMEX faced legal action from US authorities in 2020 regarding this issue.

Both platforms use KYC (Know Your Customer) verification and IP detection to restrict access from prohibited regions including the US.

Attempting to bypass these restrictions through VPNs violates the terms of service and may result in account termination and fund freezing.

What are the notable benefits of using Aibit over BitMEX for cryptocurrency trading?

Aibit typically offers a more intuitive user interface that new traders find easier to navigate. The platform also tends to have more responsive customer support.

Aibit generally provides lower latency during high market volatility, which can be crucial for executing time-sensitive trades.

Additional trading pairs and more diverse contract options give Aibit users greater flexibility compared to BitMEX’s more focused offering.

Which platform, Aibit or BitMEX, is recommended for novice traders?

Aibit is generally more suitable for beginners due to its simplified interface and educational resources. The platform offers demo accounts where you can practice without risking real funds.

BitMEX’s interface is more complex and technically oriented, which can overwhelm new traders. Its liquidation mechanisms are also less forgiving for inexperienced users making leveraged trades.

If you’re new to cryptocurrency trading, Aibit’s risk management tools and more intuitive order placement process provide a gentler learning curve.

BitMEX vs Aibit Conclusion: Why Not Use Both?

When comparing BitMEX and Aibit, you don’t necessarily need to choose just one platform. Each exchange offers unique benefits that can complement your trading strategy.

BitMEX brings experience to the table as the pioneer of perpetual contracts. This means you don’t need to worry about rolling positions at future dates. Their advanced trading features appeal to experienced traders looking for sophisticated tools.

Aibit, on the other hand, may offer different fee structures or user experiences that could better suit certain trading styles or preferences.

Benefits of using both platforms:

- Risk diversification: Spreading your assets across multiple exchanges reduces vulnerability to single platform outages

- Feature optimization: Use each platform for what it does best

- Fee advantages: Take advantage of lower fees for specific trading pairs on each platform

Many traders maintain accounts on multiple exchanges to capitalize on price differences and varying liquidity. This approach allows you to choose the best platform for each specific trade.

Remember to consider security when using multiple exchanges. Use strong, unique passwords and enable two-factor authentication on all your accounts.

By familiarizing yourself with both BitMEX and Aibit, you gain flexibility in your trading strategy and can adapt to changing market conditions more effectively.