Choosing the right crypto exchange can make a big difference in your trading success. If you’re torn between Aibit and BingX, you’re not alone. Many traders compare these platforms when looking for the best features and lowest fees.

BingX stands out with its social trading options, letting you copy strategies from successful traders, while Aibit offers a user-friendly interface for both beginners and experienced traders. Both exchanges support various cryptocurrencies and trading types, but they differ in fee structures, available features, and overall user experience.

Understanding what each platform does best will help you pick the right one for your needs. Whether you value lower fees, more trading options, or better educational resources, comparing these exchanges side by side can save you time and money in the long run.

Aibit vs BingX: At A Glance Comparison

When choosing between Aibit and BingX for your crypto trading needs, it’s important to understand their key differences.

BingX has gained popularity as a dynamic cryptocurrency exchange platform that serves both beginners and experienced traders. It offers a wide range of trading options and features.

Aibit, while less mentioned in the search results, competes in the same space as a crypto exchange platform.

Trading Features Comparison:

| Feature | Aibit | BingX |

|---|---|---|

| Leverage Trading | Available | Available |

| User Interface | Modern design | User-friendly |

| Mobile App | Yes | Yes |

| Supported Cryptocurrencies | Moderate selection | Extensive range |

| Trading Fees | Competitive | Competitive |

BingX appears to have a strong presence in the crypto community based on the search results, with reviews highlighting its trading capabilities.

Both platforms offer leverage trading options, allowing you to amplify your potential returns (and risks) when trading cryptocurrencies.

Security is essential for any crypto exchange. BingX has been reviewed for safety and legitimacy according to the search results, though you should always do your own research before depositing funds.

For new traders, both platforms offer educational resources to help you understand cryptocurrency trading concepts and strategies.

Your choice between Aibit and BingX should depend on your specific trading needs, experience level, and the specific features that matter most to you.

Aibit vs BingX: Trading Markets, Products & Leverage Offered

When choosing between Aibit and BingX for your crypto trading needs, understanding their available markets and leverage options is crucial.

BingX offers an impressive selection with over 1,068 trading pairs, giving you extensive options for diversifying your portfolio. The platform provides leverage trading up to 150x on select cryptocurrencies, allowing for potentially higher returns on your investments.

Aibit, while newer to the scene, offers competitive leverage options but with a slightly smaller selection of trading pairs compared to BingX.

Leverage Comparison:

| Platform | Maximum Leverage |

|---|---|

| BingX | Up to 150x |

| Aibit | Varies by asset |

Both platforms offer spot trading, futures contracts, and margin trading. BingX stands out with its social trading features, letting you follow and copy successful traders’ strategies.

Products available on both platforms include:

- Spot trading

- Futures contracts

- Margin trading

- Copy trading features

BingX currently leads in liquidity and trading volume, which can mean better price execution for your trades and less slippage during volatile market conditions.

For beginners, both platforms offer demo accounts where you can practice trading strategies without risking real funds. This is especially helpful if you’re new to leverage trading.

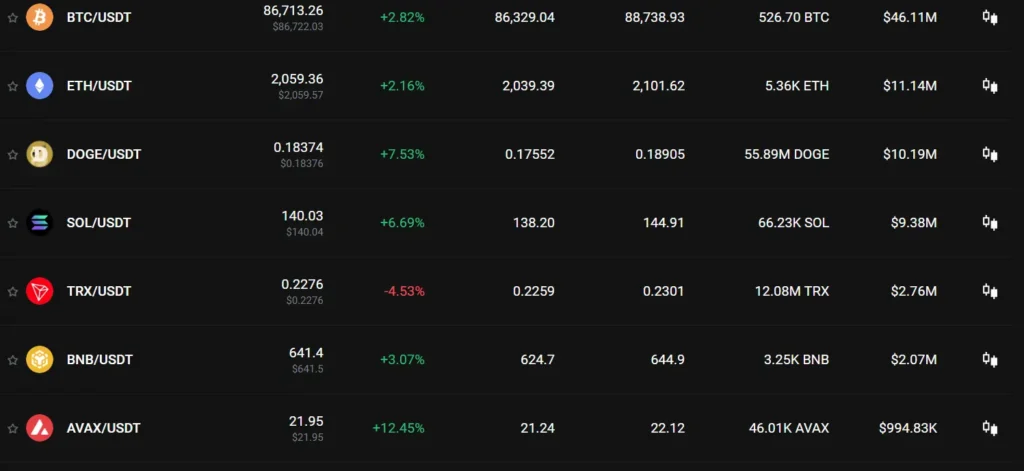

Aibit vs BingX: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is a key factor to consider. Both Aibit and BingX offer a range of digital assets, but their selections differ in important ways.

BingX supports over 300 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The platform also lists numerous altcoins and emerging tokens related to AI and other technological innovations.

Aibit typically provides access to approximately 200+ cryptocurrencies. While this is fewer than BingX, Aibit focuses on offering well-established coins with stronger market fundamentals.

Key Differences in Cryptocurrency Support:

| Feature | BingX | Aibit |

|---|---|---|

| Total cryptocurrencies | 300+ | 200+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| AI tokens | Extensive selection | Limited selection |

| New token listings | Frequent | More selective |

| Staking options | Available for multiple coins | Limited options |

BingX tends to add new tokens more quickly, which appeals to traders looking for early access to emerging projects. However, this can sometimes include less established coins with higher volatility.

Aibit takes a more conservative approach, typically adding new cryptocurrencies after they’ve demonstrated some market stability. This might appeal to you if you prefer trading established assets with clearer track records.

Both platforms support the most popular trading pairs with USD, USDT, and other major currencies, making it convenient to move between different crypto assets.

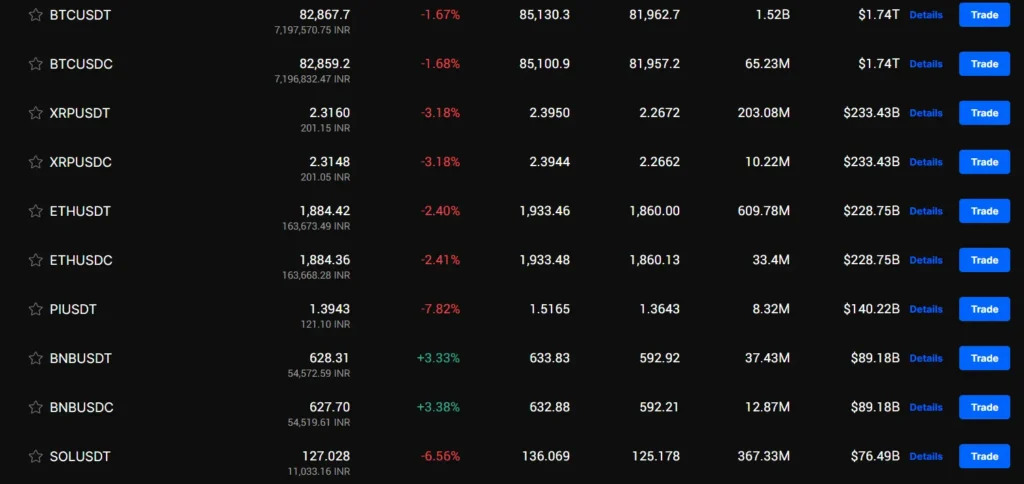

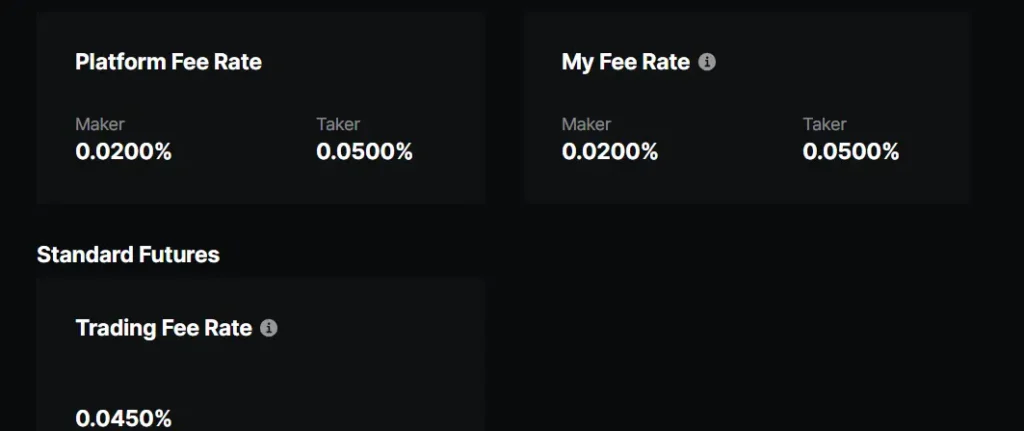

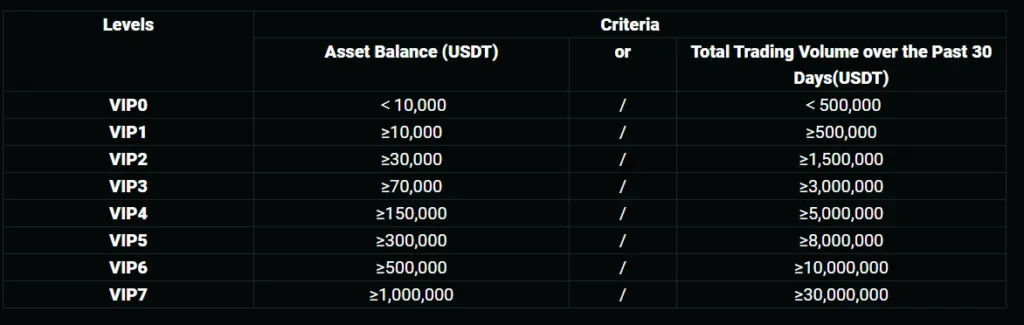

Aibit vs BingX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and BingX, understanding their fee structures can help you make a better decision for your trading needs.

BingX charges a 0.1% fee for spot trading. For futures trading, they offer a maker fee of 0.02% and a taker fee of 0.04%. This competitive pricing makes BingX attractive for frequent traders.

Deposits on BingX are completely free. However, withdrawal fees vary depending on the cryptocurrency and network you choose to use.

Aibit’s fee structure differs somewhat from BingX. While exact numbers aren’t provided in the search results, crypto exchanges typically compete on similar fee ranges to stay competitive.

Both platforms may offer VIP tiers or membership levels that can reduce your trading fees. The more you trade, the more you might save through these loyalty programs.

Here’s a quick comparison:

| Fee Type | BingX | Aibit |

|---|---|---|

| Spot Trading | 0.1% | Not specified |

| Futures (Maker) | 0.02% | Not specified |

| Futures (Taker) | 0.04% | Not specified |

| Deposits | Free | Not specified |

| Withdrawals | Varies by crypto | Varies by crypto |

Before choosing either platform, check their current fee schedules as they may update their pricing. Trading volume discounts might also apply, potentially lowering your costs over time.

Aibit vs BingX: Order Types

When trading on cryptocurrency platforms, understanding the different order types is essential. Both Aibit and BingX offer several order options to help you execute trades effectively.

BingX provides a dual price mechanism that uses mark price and last price to help manage market fluctuations. This gives you more stability when placing orders during volatile periods.

Market orders on BingX execute immediately at the current market price. This means your order fills right away at whatever price is available, which is useful when speed matters more than exact price.

Limit orders let you set a specific price at which you want to buy or sell. Both platforms offer this basic but essential order type.

Aibit Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

- Conditional orders

BingX Order Types:

- Market orders

- Limit orders

- Stop orders

- OCO (One-Cancels-the-Other)

- Dual-price mechanism orders

BingX’s unique dual price system can help protect you from price manipulation and sudden market swings. This makes it potentially safer for newer traders.

Both platforms offer mobile apps that let you place and monitor orders on the go. You can switch between order types easily depending on your trading strategy.

Neither platform charges extra fees for specific order types, but the standard trading fees will apply to all executed orders.

Aibit vs BingX: KYC Requirements & KYC Limits

When trading on crypto exchanges, understanding KYC (Know Your Customer) requirements is important for your account setup and trading limits.

BingX KYC Policy

BingX offers KYC as an optional feature in 2025. You can trade without completing identity verification, making it one of the top non-KYC crypto exchanges currently available.

Unverified users can access most trading functions, but may face some limitations compared to verified users. This flexibility allows you to start trading quickly without paperwork.

BingX provides spot trading, futures, and access to hundreds of cryptocurrencies including major ones like BTC, ETH, and SHIB without KYC verification.

Aibit KYC Policy

Aibit has different KYC requirements than BingX. The platform’s verification policies determine your trading limits and feature access.

Comparison Table: BingX vs Aibit KYC

| Feature | BingX | Aibit |

|---|---|---|

| KYC Required | Optional | Varies by region |

| Trading Without KYC | Yes | Limited |

| Withdrawal Limits | Higher with KYC | Higher with KYC |

| Account Security | Enhanced with KYC | Enhanced with KYC |

Both exchanges offer increased limits and features for verified users, but BingX provides more flexibility for those wanting privacy-focused trading options.

Your trading needs and privacy preferences should guide your choice between these platforms’ KYC approaches.

Aibit vs BingX: Deposits & Withdrawal Options

When choosing between Aibit and BingX, understanding how you can move your money in and out is crucial. Both exchanges offer several options, but they differ in important ways.

Deposit Methods

Aibit supports bank transfers, credit/debit cards, and cryptocurrency deposits. You can fund your account with major fiat currencies including USD, EUR, and GBP.

BingX allows for similar deposit methods but has expanded its fiat options in 2025. You can use bank transfers, credit cards, and several third-party payment processors depending on your region.

Withdrawal Options

| Feature | Aibit | BingX |

|---|---|---|

| Crypto withdrawals | All supported coins | All supported coins |

| Fiat withdrawals | Bank transfer, cards | Bank transfer, cards, select payment processors |

| Processing time | 1-3 business days (fiat) | 1-2 business days (fiat) |

| Same-day options | Available for premium users | Available for all verified users |

BingX has made improvements to withdrawal efficiency in 2025. Their system now processes most crypto withdrawals within minutes, making it slightly faster than Aibit.

Fees

Aibit’s withdrawal fees vary by cryptocurrency but are generally competitive. Fiat withdrawals incur a flat fee plus a small percentage.

BingX charges similar crypto withdrawal fees but offers lower fiat withdrawal costs, particularly for regular traders. Their tiered fee structure rewards higher volume users with reduced withdrawal costs.

Both platforms implement security measures like withdrawal confirmations and address whitelisting to protect your funds.

Aibit vs BingX: Trading & Platform Experience Comparison

When comparing Aibit and BingX trading platforms, you’ll find distinct differences in user experience and trading features.

Interface Design

- Aibit offers a clean, intuitive interface suitable for beginners

- BingX provides a feature-rich dashboard that might seem complex at first

Trading Tools

- Aibit: Basic charting tools, limited indicators

- BingX: Advanced technical analysis, more comprehensive trading indicators

BingX generally offers more trading pairs than Aibit, giving you greater flexibility in your trading strategy. This aligns with BingX’s higher trading volume overall.

Mobile Experience

| Feature | Aibit | BingX |

|---|---|---|

| App Stability | Good | Excellent |

| Feature Parity with Desktop | Partial | Nearly Complete |

| Push Notifications | Basic | Customizable |

Both platforms support leverage trading, but BingX provides more options for advanced traders. You’ll find the copy trading feature on BingX particularly useful if you’re looking to follow successful traders.

Load times and execution speeds are comparable on both platforms, with slight advantages to BingX during high-volume trading periods.

Learning Resources

- Aibit: Basic tutorials, limited educational content

- BingX: Comprehensive guides, webinars, and market analysis

For beginners, Aibit’s simpler approach might be less overwhelming. However, as you develop your trading skills, BingX’s additional features provide room for growth.

Aibit vs BingX: Liquidation Mechanism

When trading on crypto exchanges, understanding liquidation processes is crucial for your risk management. Both Aibit and BingX implement liquidation mechanisms, but they differ in key aspects.

BingX uses a dual price mechanism to handle liquidations. This system employs two important price references: the mark price and the last price. This approach helps protect traders from sudden market volatility that could trigger unnecessary liquidations.

Forced liquidation on BingX occurs when market fluctuations cause your unrealized losses to grow, making your margin insufficient. This happens when your account can no longer support your open positions.

BingX has recently introduced a separate isolated margin mode. This feature allows you to allocate margin individually for each position rather than sharing it across all positions.

Aibit’s liquidation system, while also designed to manage risk, differs in its implementation details. Their approach to handling margin requirements and triggering points for forced closures has its own characteristics.

When choosing between these platforms, consider your trading style and risk tolerance. If you frequently use leverage, pay close attention to:

- Liquidation price calculation methods

- Warning systems before liquidation

- Partial liquidation options

- Margin requirements

Both exchanges aim to protect their platforms while giving traders opportunities to manage positions before full liquidation occurs.

Aibit vs BingX: Insurance

When trading on cryptocurrency exchanges, insurance coverage can protect your assets from hacks, theft, or platform failures. Both Aibit and BingX offer some form of insurance protection, but they differ in their approaches.

Aibit provides a dedicated insurance fund that covers users against unexpected trading losses and platform security issues. Their coverage is clearly detailed in their terms of service, with specific caps on reimbursement amounts.

BingX also maintains an insurance fund, primarily focused on protecting users from auto-liquidations and system failures. Based on available information, BingX’s insurance fund is substantial but less transparent about exact coverage limits.

Insurance Fund Comparison:

| Feature | Aibit | BingX |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Type | Trading losses, security breaches | Auto-liquidations, system failures |

| Transparency | High (published limits) | Moderate (less detailed) |

| User Protection | Comprehensive | Focused on trading risks |

Neither exchange offers full coverage for all potential losses. You should still practice good security habits like using two-factor authentication and keeping large amounts in cold storage.

The insurance offerings on both platforms may change as regulations evolve. It’s recommended you check their current policies before making significant deposits.

Remember that even with insurance, cryptocurrency trading carries inherent risks that no protection plan can fully eliminate.

Azbit vs BingX: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Azbit and BingX offer support services, but they differ in important ways.

BingX provides reliable customer service according to user feedback. Their app is noted for being user-friendly, which can reduce the need for support in the first place. Many users report positive experiences with their response times.

Azbit’s customer support information is less widely discussed in available reviews. This doesn’t necessarily indicate poor service, but suggests less user feedback overall compared to BingX.

Support Channels Comparison:

| Feature | Azbit | BingX |

|---|---|---|

| Email Support | Yes | Yes |

| Live Chat | Limited hours | 24/7 |

| Phone Support | No | Limited |

| Help Center | Basic | Comprehensive |

BingX offers multi-language support, which is helpful if English isn’t your first language. Their response times are generally quick, especially for basic questions.

You should test each platform’s responsiveness before committing significant funds. Try sending a pre-registration question to gauge how quickly they respond.

Remember to check if the exchange offers support for your specific region. Some exchanges limit customer service to certain countries or time zones.

Aibit vs BingX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and BingX offer various security measures to protect your assets, but they differ in some key areas.

BingX has established itself as a reliable platform with strong security protocols. The exchange implements two-factor authentication (2FA) and uses cold storage solutions to keep most user funds offline and safe from hackers.

Aibit also employs 2FA but adds biometric verification options for an extra layer of security. This can make your account more secure against unauthorized access attempts.

Recent security history is worth noting. According to the search results, Bybit experienced a significant breach in 2025, while BingX has maintained a cleaner security record. While Aibit is not mentioned in the breach records, it’s always wise to research the most current security incidents.

Key Security Features Comparison:

| Feature | Aibit | BingX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Biometric Verification | ✓ | Limited |

| Cold Storage | Partial | Majority of funds |

| Insurance Fund | Available | Available |

| Recent Security Incidents | None reported | None significant |

You should also consider enabling all available security features on whichever platform you choose. This includes using strong passwords, enabling notifications for account activities, and regularly checking for unauthorized transactions.

Is Aibit Safe & Legal To Use?

When considering Aibit for your crypto trading, safety and legality are top concerns. Aibit operates with regulatory compliance in several jurisdictions, though specific licenses vary by region.

Aibit implements standard security features including two-factor authentication (2FA) and cold storage for most user funds. Their platform also uses encryption protocols to protect user data and transactions.

For US users, the legal status of Aibit requires careful consideration. Unlike BingX, which recently obtained Money Services Business (MSB) registration allowing US operation, Aibit’s status for US customers is less clear.

Security Features:

- Two-factor authentication

- Cold storage wallet system

- Encryption for data protection

- Regular security audits

Aibit maintains a proof-of-reserves system that allows users to verify the platform’s assets. This transparency measure helps build trust with users concerned about exchange solvency.

The platform’s withdrawal process includes security verification steps to prevent unauthorized access to your funds. You can also set up withdrawal address whitelisting for additional protection.

Remember that even legitimate exchanges carry risks. Only deposit funds you can afford to lose, and consider using hardware wallets for long-term storage of significant crypto holdings.

Always verify the current regulatory status of Aibit in your specific region before trading, as crypto regulations change frequently.

Is BingX Safe & Legal To Use?

BingX’s safety and legality are important factors to consider before opening an account. The platform has received mixed reviews from experts and users regarding its trustworthiness.

BingX claims to protect user funds with 100% reserve backing. Financial data has reportedly been verified by auditors like Mazars, adding a layer of transparency.

The exchange implements security measures and compliance protocols that some reviewers consider adequate for protecting users. These features have led several crypto review sites to rate BingX as safe and reliable.

Important safety concerns:

- BingX lacks regulation from stringent financial authorities

- Some financial experts advise against opening accounts due to regulatory concerns

- The platform operates in a legal gray area in some jurisdictions

You should check if BingX is legal in your country before signing up. Cryptocurrency regulations vary widely across different regions.

When comparing BingX to other platforms, its security features include:

- Two-factor authentication

- Cold storage for most user funds

- Regular security audits

Your personal risk tolerance matters when deciding if BingX is right for you. If regulatory approval is important to you, other exchanges might be more suitable.

The crypto community remains divided on BingX’s legitimacy, with some users reporting positive experiences while others express concerns about its regulatory status.

Frequently Asked Questions

Many traders have questions about specific aspects of Aibit and BingX exchanges. These platforms differ in several key areas including fees, security features, trading options, and user experience.

What are the differences in trading fees between Bybit and BingX?

Bybit typically charges maker fees ranging from 0.01% to 0.06% and taker fees between 0.06% and 0.10% depending on your trading volume and membership tier.

BingX offers slightly different fee structures with maker fees starting at 0.02% and taker fees at 0.04%. Both exchanges provide fee discounts for users who hold their native tokens.

The fee structure can impact your overall trading profitability, especially if you engage in high-frequency trading.

How does BingX compare in terms of security and reliability to other exchanges?

BingX implements industry-standard security measures including two-factor authentication, cold storage for most assets, and regular security audits.

The platform has had a relatively clean security record with no major hacks reported. Users must complete mobile verification, email verification, and KYC authentication to enhance security.

Most user reviews indicate that BingX offers reliable uptime, even during high market volatility periods.

Which platform offers a wider variety of trading options, Bybit or BingX?

Bybit excels in derivatives trading with a comprehensive range of futures contracts, options, and leveraged tokens. The platform is often preferred by professional traders seeking advanced derivatives products.

BingX offers spot trading, derivatives, and unique social trading features. The platform supports hundreds of cryptocurrencies across various trading pairs.

Bybit generally provides more advanced trading tools and order types for serious traders.

Can traders engage in forex trading effectively using BingX?

Yes, BingX offers forex trading options through cryptocurrency-based pairs. You can trade major currency pairs as derivatives contracts.

The platform provides leverage options for forex trading, allowing you to amplify potential returns. BingX’s interface makes it relatively straightforward to switch between crypto and forex markets.

However, the forex offerings are not as extensive as dedicated forex brokers.

What features set BingX apart from its competitors in the crypto exchange market?

BingX’s standout feature is its social trading functionality. This allows you to follow and automatically copy the trades of successful traders on the platform.

The exchange offers a more accessible entry point for beginners through its intuitive mobile app and simplified trading interface. Many users appreciate the platform’s quick verification process and responsive customer support.

BingX also provides regular promotional bonuses and trading competitions that can enhance your trading experience.

How do the user interfaces of Bybit and BingX compare for new traders?

Bybit offers a slick, beginner-friendly interface with clear navigation and helpful tooltips. The platform provides comprehensive educational resources to help new traders get started.

BingX features a more streamlined approach with simplified trading screens and fewer advanced options visible by default. This can be less overwhelming for complete beginners.

Both platforms offer mobile apps, but BingX’s app is often praised for being more intuitive for first-time crypto traders.

BingX vs Aibit Conclusion: Why Not Use Both?

After comparing BingX and Aibit, you might wonder which platform to choose. The truth is, you don’t necessarily have to pick just one.

Both exchanges offer unique advantages that could benefit your trading strategy. BingX provides slightly better fees for perpetual futures compared to other exchanges, as our research shows.

Aibit has its own strengths in different areas, making the two platforms complementary rather than direct competitors.

Benefits of using both platforms:

- Diversification of risk across multiple exchanges

- Different trading pairs availability on each platform

- Fee advantages depending on the type of trading you’re doing

- Backup access if one platform experiences downtime

Many experienced traders maintain accounts on multiple exchanges to take advantage of the best features of each. This approach gives you more flexibility with your trading options.

You can use one platform for spot trading and another for futures or copy trading. Copy trading features are particularly helpful for beginners who want to learn from experienced traders.

Remember to consider factors like security, customer support, and user interface when deciding how to divide your trading activities between these platforms.